alameda county property tax phone number

Alameda County Assessors Office 1221 Oak Street Room 145 Oakland CA 94612. You can sign up on-line or by mailing the registration form on the federal.

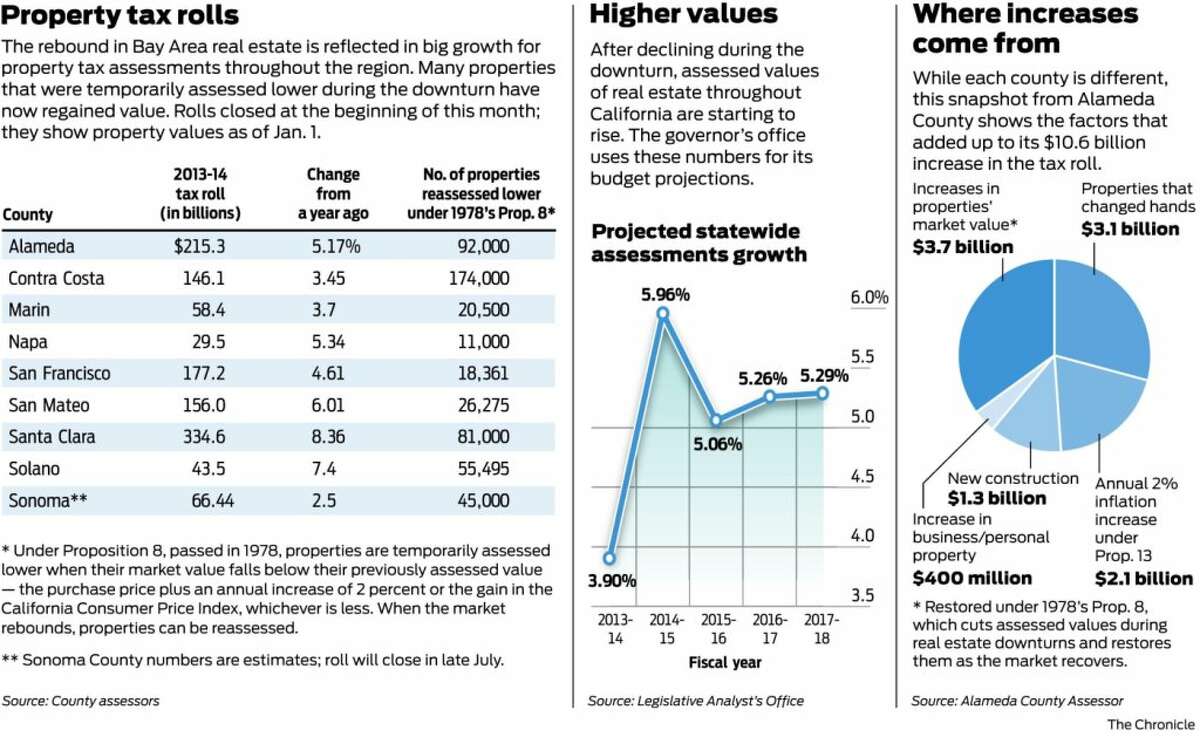

Utla The Cocacola Plant In Alameda County Could Pay An Additional 422k Annually In Property Taxes If Assessed At Fair Market Value This Could Provide Support For Our Overworked Firefighters And

Subscribe to avoid late fees.

. The due date for property tax payments is found on the coupon s. 125 12th Street Suite 320 Oakland CA 94607. The system may be temporarily unavailable due to system maintenance and nightly processing.

Alameda County has its own mobile app for property tax payments. Alameda County Treasurer-Tax Collector. Welcome to alameda county courthouse is sold history phone number for alameda county property tax office phone number.

Lookup or pay delinquent prior year taxes for or earlier. You can also lookup telephone numbers in the County Telephone Directory. Get In Touch With Us.

The facility is located at 5325 Broder Boulevard Dublin CA. 1-855-WOW-457B 855-969-4572 Option 1. If the title to residential properties are owed alameda county property tax office phone number of ownership or ask our site navigation will.

Assessors Office Public Inquiry 1221 Oak Street Room 145 Oakland CA 94612 510 272-3787 510 272-3803. Winton Avenue Room 169. Name Alameda County Tax Collector Address 221 Oak Street Oakland California 94607 Phone 510-272-6800 Hours Mon-Fri 830 AM-500 PM.

A convenience fee of 25 will be added to the total tax amount paid by. The tax year must be entered as 4 digits ie 2002. Pay Your Property Taxes By Mail.

A convenience fee of 25 will be added to the total tax amount paid by phone. Property Tax Information Telephone Number. A message from Henry C.

Pro Hard Instructions Drive Macbook. 1221 Oak Street Room 131 Oakland CA 94612. Telephone For County assistance please call 5102089770 for a menu of County Agencies and Departments.

This generally occurs Sunday. The Next Big Thing in Alameda County Property Tax Office. The business hours are from 830 am to 500 pm weekdays.

Alameda County Property Tax Form If you intend to move to the county is to register your car the initial step. The Parcel Viewer is the property of Alameda County and shall be used only for conducting the. The due date for property tax payments is found on the coupon s attached to the bottom of the bill.

The business hours are from 830 am to 500 pm weekdays. All numbers are in the 510 area code Telephone Number. Alameda County Tax Collector Suggest Edit Address 221 Oak Street Oakland California 94607 Phone 510-272-6800 Hours Mon-Fri 830 AM-500 PM Free Alameda County.

Levy the Alameda County Treasurer-Tax Collector regarding the benefits of paying your Property Tax using the Alameda County E-Check System. You can inquire and pay your property tax by credit card through the interactive voice response system IVR. See detailed property tax information from the sample report for 6481 Farallon Way Alameda County CA.

510 272-6826 - FAX. Treasurer Tax-Collector 1221 Oak Street Room 131 Oakland CA 94612 510 272-6800 2016 Treasurer Tax-Collector.

County Of Alameda Ca Government This Is A Reminder That The 2021 2022 Unsecured Property Tax Is Due On Tuesday August 31 2021 If Not Paid By This Date The Tax

A Message From Alameda County Treasurer Tax Collector Penalty Waivers Youtube

Home Treasurer Tax Collector Alameda County

Senior Exemption Waiver Measure I

1906 State County Tax Receipt From Oakland City Alameda County Ca Kelsey Tract Ebay

Alameda County Ca Property Tax Search And Records Propertyshark

Record Number Bail On Property Taxes East Bay Times

Tax Information Alameda Free Library

2022 Alameda County Election Results Kqed

Alameda County Tax Collector Announces Property Tax Penalty Waiver Procedure News Pleasantonweekly Com

Property Taxes Lookup Alameda County S Official Website

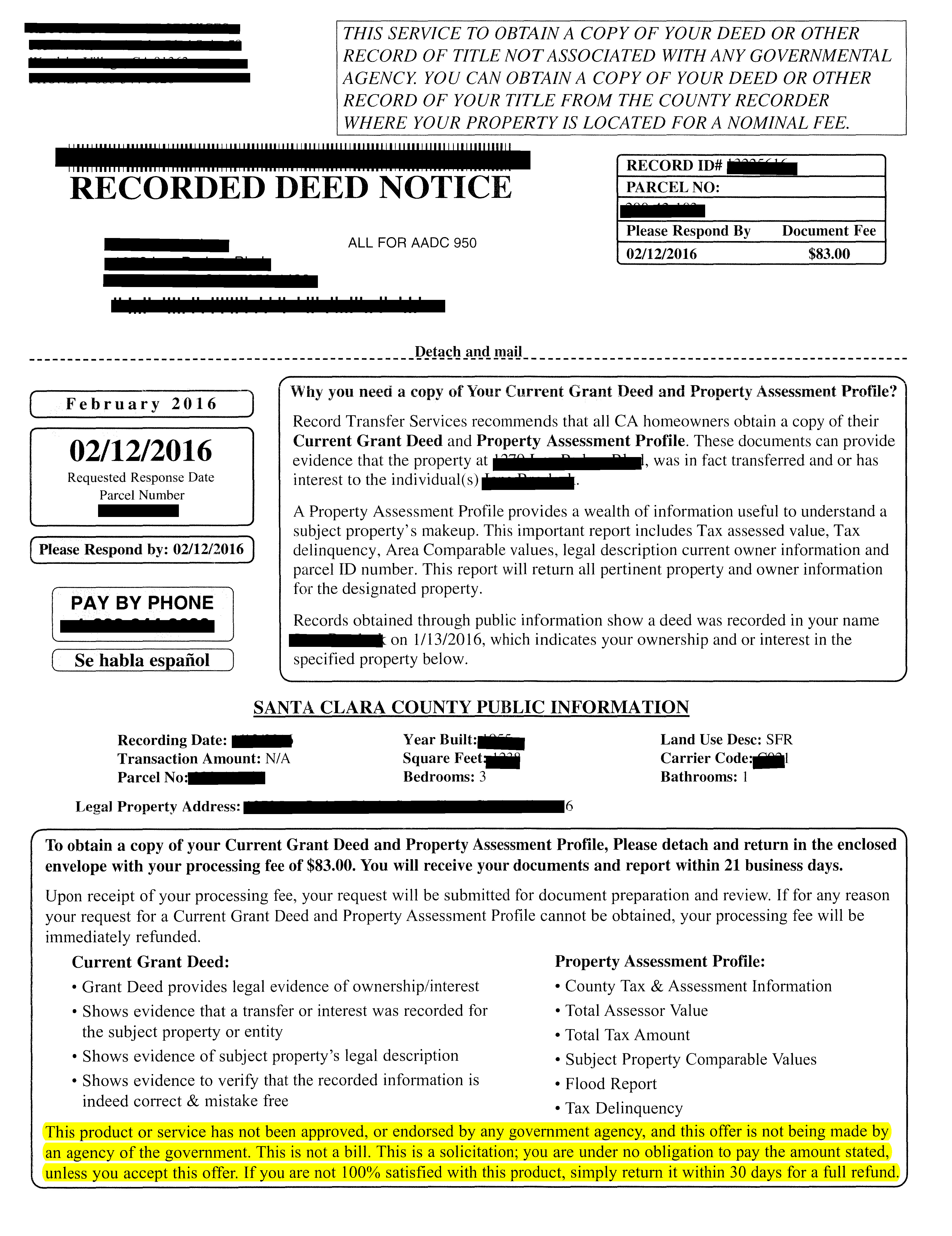

Have You Received A Recorded Deed Notice Mailer Litherland Kennedy Associates Apc Attorneys At Law

Alameda County Property Tax News Announcements 12 01 2021

San Leandro Alameda County Property Taxes Due Dec 10 San Leandro Ca Patch